Introduction to the Transaction

On December 31, 2023, Glenview Capital Administration, led by Larry Robbins (Trades, Portfolio), made a big addition to its funding portfolio by buying 1,972,212 shares of DXC Know-how Co (NYSE:DXC). This transaction elevated the agency’s whole holdings in DXC to 13,006,773 shares, marking a considerable vote of confidence within the IT companies supplier. The commerce, executed at a worth of $22.87 per share, had a 1.02% influence on the portfolio, bringing the place to six.7% of the agency’s holdings and 6.86% of DXC’s excellent shares.

Profile of Larry Robbins (Trades, Portfolio)

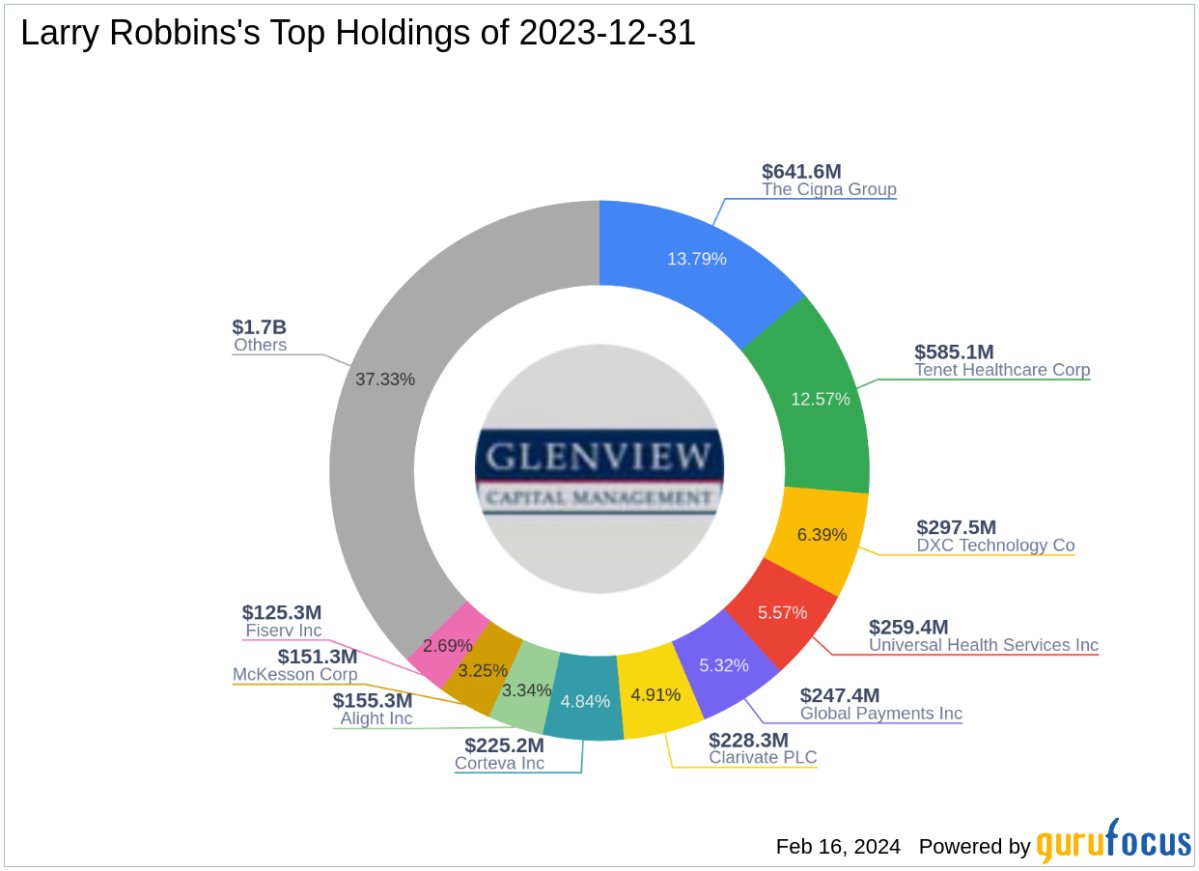

Glenview Capital Administration, established in 2000 by Larry Robbins (Trades, Portfolio), is a famend funding administration agency with a status for delivering engaging absolute returns. The agency’s funding technique is anchored in rigorous basic analysis and a meticulous safety choice course of. With a major deal with the U.S. market and a few publicity to Western Europe, Glenview Capital Administration has a various portfolio, together with high holdings equivalent to The Cigna Group (NYSE:CI), DXC Know-how Co (NYSE:DXC), and Tenet Healthcare Corp (NYSE:THC). As of the most recent knowledge, the agency manages an fairness portfolio valued at $4.65 billion, with a robust inclination in direction of the Healthcare and Know-how sectors.

DXC Know-how Co at a Look

DXC Know-how Co, headquartered within the USA, has been a outstanding participant within the IT companies business since its IPO on November 26, 1968. The corporate operates via two predominant segments: International Enterprise Providers (GBS) and International Infrastructure Providers (GIS), with GIS being the main income generator. With a market capitalization of $4.05 billion and a present inventory worth of $22.17, DXC Know-how Co is taken into account modestly undervalued in response to GuruFocus’s GF Worth of $30.88.

Evaluation of the Commerce

The acquisition of DXC shares by Glenview Capital Administration displays a strategic transfer by Larry Robbins (Trades, Portfolio)’ agency. The commerce worth of $22.87 is at the moment above the inventory’s market worth of $22.17, indicating a slight lower in worth because the transaction date. Nevertheless, with a GF Worth of $30.88, the inventory remains to be thought of modestly undervalued, suggesting potential for progress. The commerce has solidified DXC’s place as a key holding in Robbins’ portfolio, aligning with the agency’s funding philosophy of specializing in undervalued alternatives.

DXC Know-how Co’s Monetary Well being

DXC Know-how Co’s monetary metrics and GF Scores paint a combined image. The corporate has a GF Rating of 71/100, indicating doubtless common efficiency. Its Monetary Energy and Profitability Rank each stand at 5/10, whereas the Progress Rank is at a decrease 2/10. Nevertheless, the inventory boasts an ideal GF Worth Rank of 10/10 and a robust Momentum Rank of 8/10. The corporate’s Piotroski F-Rating is 5, and its Altman Z rating is 0.73, indicating some monetary stability considerations.

Sector and Market Context

Larry Robbins (Trades, Portfolio)’ Glenview Capital Administration has a notable publicity to the Know-how sector, with DXC Know-how Co being a big funding. This sector allocation enhances the agency’s largest sector holding, Healthcare, showcasing a diversified strategy to worth investing. The agency’s technique typically entails balancing investments throughout sectors that supply each progress and stability, with Know-how and Healthcare becoming this criterion properly.

Broader Market Implications

The funding in DXC Know-how Co by Larry Robbins (Trades, Portfolio)’ agency is a transfer that worth buyers might watch carefully. It displays a perception within the potential of the Know-how sector and the particular alternatives inside DXC Know-how Co. This commerce comes at a time when the market is evaluating the intrinsic values and progress prospects of tech firms, making Robbins’ resolution notably noteworthy.

Conclusion

In abstract, Larry Robbins (Trades, Portfolio)’ Glenview Capital Administration has elevated its stake in DXC Know-how Co, aligning with its funding technique of figuring out undervalued alternatives with potential for progress. The agency’s vital place in DXC, coupled with the corporate’s modest undervaluation and combined monetary metrics, suggests a calculated wager on the corporate’s future efficiency. Because the market continues to evolve, the efficiency of DXC Know-how Co will probably be an vital indicator of the success of Robbins’ funding strategy.

This text, generated by GuruFocus, is designed to supply basic insights and isn’t tailor-made monetary recommendation. Our commentary is rooted in historic knowledge and analyst projections, using an neutral methodology, and isn’t meant to function particular funding steering. It doesn’t formulate a advice to buy or divest any inventory and doesn’t contemplate particular person funding aims or monetary circumstances. Our goal is to ship long-term, basic data-driven evaluation. Remember that our evaluation won’t incorporate the newest, price-sensitive firm bulletins or qualitative info. GuruFocus holds no place within the shares talked about herein.

This text first appeared on GuruFocus.